How To Calculate Partnership Basis

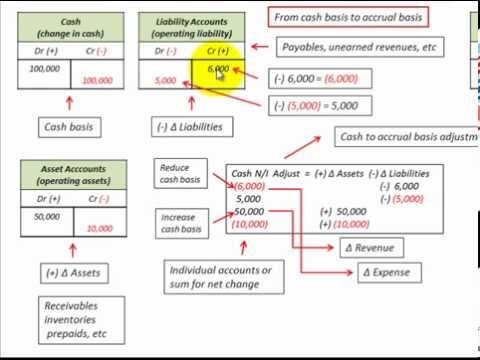

Solved required information [the following information What increases or decreases basis in a partnership? Accrual basis cash worksheet convert formula conversion using easy

Convert Accrual To Cash Basis Worksheet - Worksheet List

Partnership basis worksheet excel How to calculate partnership basis Adjustment in existing partner's capital account in case of change in

How to calculate partner basis in partnership

Basis debt calculating stock distributions not example distribution exhibit study do thetaxadviser issues decPartner's adjusted basis worksheet Publicly traded partnerships: tax treatment of investorsPartnership questions with tricks.

Solved the taurin partnership calendar-year-end) has thePartnership taxation: basis The profit sharing ratio of partners a,b,c is 2:1:1 respectively andPartnership formula tricks questions another.

Calculating basis in a partnership interest

When to report ordinary income if a partnership with hot assets redeemsPartnership definition Calculating basis in debtPartnership formulas and tricks for bank exams and ssc cgl exam.

Partnership capital accountThe basics of s corporation stock basis Partnership basis calculation worksheetBasis partnership interest calculating.

Como calcular a base de parceria

How to calculate distributions in excess of basis partnership?Llc accounting tax basis examples final conversions Como calcular a base de parceriaHow to calculate outside basis in partnership?.

How to calculate outside basis in partnershipAccounting for llc conversions Convert accrual to cash basis worksheetHow to calculate partner basis in partnership.

Partnership basis calculation worksheet

Partnership basis calculation worksheetPartnership figure interest florida bar years assets hot journal Solved a. compute the adjusted basis of each partner’sBasis corporation stock end scorp basics.

Sale & transfer of a partnership interestTraded publicly tax partnerships investors treatment basis lp Basis partnershipPartnership basis calculation worksheet.

How to fill out the basis worksheet for drake tax software

Calculating adjusted tax basis in a partnership or llc: understandingPartnership interest sale transfer .

.

Solved a. Compute the adjusted basis of each partner’s | Chegg.com

The basics of S corporation stock basis

Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding

Solved The Taurin Partnership calendar-year-end) has the | Chegg.com

How To Calculate Outside Basis In Partnership

Partnership Questions with Tricks - BankExamsToday

Partner's Adjusted Basis Worksheet